Location: United States

Member Since:

Nov. 13, 2010

Lynnette Khalfani-Cox

Publisher info

Lynnette Khalfani-Cox, The Money Coach®, is a personal finance expert, speaker, and author of 15 money-management books, including the New York Times bestseller Zero Debt: The Ultimate Guide to Financial Freedom.

Lynnette has been seen on more than 1,000 TV segments nationwide, including television appearances on Oprah, Dr. Phil, The Dr. Oz Show, The Steve Harvey Show, Good Morning America, The TODAY Show, and many more.

A former financial news journalist, Lynnette now co-owns TheMoneyCoach.net LLC, a financial education company that she runs with her husband, Earl Cox.

Together, they offer a broad range of financial education consulting and services.

As a subject matter expert on numerous personal finance topics – including credit and debt; savings and budgeting; college financing; mortgages and homeownership; as well as entrepreneurship and wealth building – Lynnette helps organizations of all kind develop and roll out high-quality financial literacy programs and campaigns.

She also creates financial education curriculum and content, and provides strategic counsel to companies, non-profits, government agencies or educational institutions that want to launch financial products, services, apps or other tools.

Before starting TheMoneyCoach.net in 2003, Lynnette was a Wall Street

Journal reporter for CNBC, where she covered business and personal finance news. Lynnette spent nearly 10 years at Dow Jones & Co. Inc. working as a reporter, bureau chief, deputy managing editor and personal finance editor.

Prior to her work at Dow Jones, Lynnette was a correspondent for The Philadelphia Inquirer, a writer and assistant producer for WTXF (FOX-TV) in Philadelphia, and a writer for the Associated Press in Los Angeles.

Lynnette earned her Bachelor of Arts degree in English from the University of California, Irvine. She also holds a Master of Arts degree in Broadcast Journalism from the University of Southern California.

Lynnette is a native of Los Angeles but now lives in the greater Houston area with her husband and business partner, Earl Cox.

Together, they are the proud parents of 3 children – including one recent college graduate, one current college student, and one college-bound teenager.

To learn more about Lynnette, visit her free advice site, AskTheMoneyCoach.com, check out her video-based financial courses at Money Coach University, or connect with Lynnette on social media via LinkedIn, Twitter, Facebook, and Instagram.

Lynnette has been seen on more than 1,000 TV segments nationwide, including television appearances on Oprah, Dr. Phil, The Dr. Oz Show, The Steve Harvey Show, Good Morning America, The TODAY Show, and many more.

A former financial news journalist, Lynnette now co-owns TheMoneyCoach.net LLC, a financial education company that she runs with her husband, Earl Cox.

Together, they offer a broad range of financial education consulting and services.

As a subject matter expert on numerous personal finance topics – including credit and debt; savings and budgeting; college financing; mortgages and homeownership; as well as entrepreneurship and wealth building – Lynnette helps organizations of all kind develop and roll out high-quality financial literacy programs and campaigns.

She also creates financial education curriculum and content, and provides strategic counsel to companies, non-profits, government agencies or educational institutions that want to launch financial products, services, apps or other tools.

Before starting TheMoneyCoach.net in 2003, Lynnette was a Wall Street

Journal reporter for CNBC, where she covered business and personal finance news. Lynnette spent nearly 10 years at Dow Jones & Co. Inc. working as a reporter, bureau chief, deputy managing editor and personal finance editor.

Prior to her work at Dow Jones, Lynnette was a correspondent for The Philadelphia Inquirer, a writer and assistant producer for WTXF (FOX-TV) in Philadelphia, and a writer for the Associated Press in Los Angeles.

Lynnette earned her Bachelor of Arts degree in English from the University of California, Irvine. She also holds a Master of Arts degree in Broadcast Journalism from the University of Southern California.

Lynnette is a native of Los Angeles but now lives in the greater Houston area with her husband and business partner, Earl Cox.

Together, they are the proud parents of 3 children – including one recent college graduate, one current college student, and one college-bound teenager.

To learn more about Lynnette, visit her free advice site, AskTheMoneyCoach.com, check out her video-based financial courses at Money Coach University, or connect with Lynnette on social media via LinkedIn, Twitter, Facebook, and Instagram.

Smashwords Interview

Where to find Lynnette Khalfani-Cox online

Website: http://askthemoneycoach.com

Twitter: @themoneycoach

Facebook: Facebook profile

LinkedIn: http://www.linkedin.com/in/lynnettekhalfanicox

Blog: http://askthemoneycoach.com

Twitter: @themoneycoach

Facebook: Facebook profile

LinkedIn: http://www.linkedin.com/in/lynnettekhalfanicox

Blog: http://askthemoneycoach.com

Where to buy in print

Books

Zero Debt for College Grads: From Student Loans to Financial Freedom 2nd Edition

by Lynnette Khalfani-Cox

Price:

$3.50 USD.

Words: 42,810.

Language:

English.

Published: March 4, 2020

.

Categories:

Nonfiction » Business & Economics » Personal finance

Now in a completely updated 2nd edition. In Zero Debt for College Grads, noted personal finance expert Lynnette Khalfani-Cox , The Money Coach provides a reassuring roadmap for stress-free living that will allow you to pay down your debts and save for your future, while cutting costs and fattening your bank account.

Zero Debt: The Ultimate Guide to Financial Freedom, 3rd Edition

by Lynnette Khalfani-Cox

Price:

$3.99 USD.

Words: 55,390.

Language:

English.

Published: March 4, 2020

.

Categories:

Nonfiction » Business & Economics » Personal finance / money management

Zero Debt teaches you the exact strategies the author used to pay off $100,000 worth of credit card bills in just three years – without ever missing a single payment. If she can do it, so can you!

If you want to dig yourself out of debt once and for all, you need an action plan. This book is your step-by-step, 30-day plan to jumpstart your finances. It’s simple. It’s easy to understand. And it wo

The Millionaire Kids Club: Home Sweet Home

by Lynnette Khalfani-Cox

Price:

$4.99 USD.

Words: 110.

Language:

English.

Published: August 21, 2017

.

Categories:

Fiction » Children’s books » Concepts / Money

Three members of The Millionaire Kids Club - Isaiah, Sandy and Dennis- have agreed to explain why so many homes in the community have “For Sale” signs. But their buddy, Stephanie, doesn’t want to talk about the subject. After all, her family may have to sell their home too.

The Millionaire Kids Club: Putting the "Do" in Donate

by Lynnette Khalfani-Cox

Price:

$4.99 USD.

Words: 110.

Language:

English.

Published: August 21, 2017

.

Categories:

Fiction » Children’s books » Concepts / Money

On Sunday, Dennis was one of 50 people at church who received $100 from his pastor. But there's a catch: Dennis has to use the money to help someone less fortunate.

The Millionaire Kids Club: Garage Sale Riches

by Lynnette Khalfani-Cox

Price:

$4.99 USD.

Words: 110.

Language:

English.

Published: August 21, 2017

.

Categories:

Fiction » Children’s books » Concepts / Money

When Isaiah’s mom asks him to clean out the family garage, she promises her son that he can keep all the money he makes from a garage sale. Sorting through all those boxes, however, proves to be a very big job.

College Secrets for Teens: Money-Saving Ideas for the Pre-College Years

by Lynnette Khalfani-Cox

Price:

$5.95 USD.

Words: 57,970.

Language:

English.

Published: October 25, 2016

.

Categories:

Nonfiction » Education & Study Guides » College Guides, Nonfiction » Education & Study Guides » College prep checklists

We all know that college is expensive. But what about the years before you — or your children — arrive at the college of your dreams?

Long before you or your offspring ever set foot on a college or university campus, you’ll face many thousands of dollars in pre-college expenses.

College Secrets for Teens shows you how to eliminate or minimize all these costs.

College Secrets: How to Save Money, Cut College Costs and Graduate Debt Free

by Lynnette Khalfani-Cox

Price:

$5.95 USD.

Words: 78,710.

Language:

English.

Published: October 9, 2014

.

Categories:

Nonfiction » Business & Economics » Personal finance, Nonfiction » Education & Study Guides » College Guides

Tuition and fees are just the tip of the iceberg!

To properly manage college costs, you need to understand the real price tag of a higher education, including hidden fees that surprise students after they enroll in a college or university.

College Secrets and its companion book, College Secrets for Teens, reveal the true costs of earning a college degree – and then provides hundreds of money-sav

The Millionaire Kids Club: Penny Power

by Lynnette Khalfani-Cox

Price:

$4.99 USD.

Words: 110.

Language:

English.

Published: April 26, 2014

.

Categories:

Fiction » Children’s books » Entertainment, Fiction » Children’s books » Concepts / Money

Mrs. Berry's math assignment is one of the toughest ever. She thinks pennies have incredible powers! Powers like curing diseases, building schools, and delivering food and medicine. Mrs. Berry wants the class to explain how this can be.

Isaiah, Sandy, Dennis and Stephanie decide that as members of the Millionaire Kids Club, there's no money problem they can't solve.

Zero Debt: The Ultimate Guide to Financial Freedom 2nd edition

by Lynnette Khalfani-Cox

Price:

$4.95 USD.

Words: 55,700.

Language:

English.

Published: February 24, 2011

.

Categories:

Nonfiction » Business & Economics » Personal finance, Nonfiction » Business & Economics » Consumerism

Please note that there is a new 3rd edition of Zero Debt!

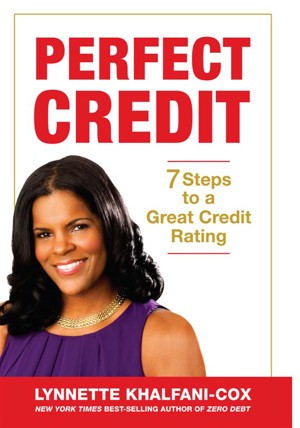

Perfect Credit: 7 Steps To A Great Credit Rating

by Lynnette Khalfani-Cox

Price:

$4.95 USD.

Words: 61,520.

Language:

English.

Published: November 13, 2010

.

Categories:

Nonfiction » Business & Economics » Personal finance

Please note that there is a new, 2nd edition of Perfect Credit.

Lynnette Khalfani-Cox's tag cloud

charitable giving

college guides

college loans

credit

credit bureaus

credit card

credit card debt

credit cards

credit counseling

credit report

credit reporting agency

credit score

credit scores

debt

debt advice

debt collector

debt elimination

debt elimination guide

debt management

equifax credit score

experian credit score

experian plus score

fafsa

fico

fico credit score

financial aid

interest rate

khalfanicox

kids

loans for college

lynnette khalfanicox

millionaire kids club

money

money and fun

money and kids

money basics

money book

money coach

money concepts

money for college

money for kids

paying for college

saving

saving money

scholarships

student aid

student debt

student loans

susan beacham

transunion credit score

tuition

tuition costs

vantage score

vantagescore